Jan 27, 2024The amounts begin to phase out at: $182,100 in 2023 and $191,950 in 2024 for taxpayers not filing a joint return. $364,200 in 2023 and $383,900 in 2024 for married taxpayers filing jointly. Charitable contributions: You can deduct up to $300 in charitable cash contributions on top of your standard deduction for 2020.

Are Home Improvements Tax-Deductible? | Dumpsters.com

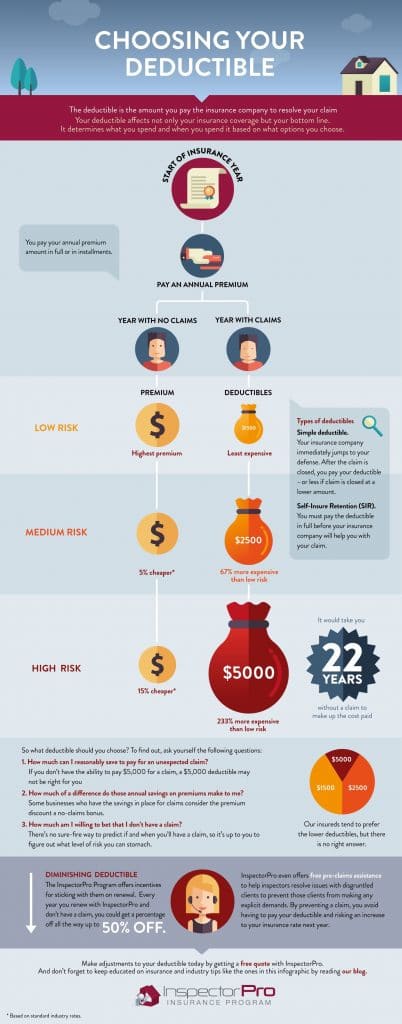

A deductible is the amount you pay out of pocket before your insurance coverage begins, while an out-of-pocket maximum is the total amount you are responsible for paying out of pocket for covered expenses. Once you reach your out-of-pocket maximum, your insurance will cover the remaining costs. 8.

Source Image: theprovince.com

Download Image

Nov 29, 2023How a car insurance deductible works. If you have a $500 deductible and your repair costs are $2,000, you’d pay the initial $500 and your insurance company would cover the remaining $1,500. Generally, your insurance company subtracts the deductible amount from your claims payout. You’ll be responsible for paying the $500 directly to the

Source Image: inspectorproinsurance.com

Download Image

Top Tax Breaks for Online Businesses: 4 Expenses to Claim To get started, follow these steps: Visit the Content Claiming Portal. Click Create claims to upload selected reference files and choose your desired enforcement. Once processed, you’ll see a green checkmark under Status. There’s no limit on how much content you can claim in total, but you can upload up to 50 works to the portal at a time.

Source Image: time.com

Download Image

Can I Change My Deductible After Filing A Claim

To get started, follow these steps: Visit the Content Claiming Portal. Click Create claims to upload selected reference files and choose your desired enforcement. Once processed, you’ll see a green checkmark under Status. There’s no limit on how much content you can claim in total, but you can upload up to 50 works to the portal at a time. Feb 21, 2024Changes to credits and deductions for tax year 2023. Standard deduction amount increased. For 2023, the standard deduction amount has been increased for all filers. The amounts are: Single or married filing separately — $13,850. Head of household — $20,800. Married filing jointly or qualifying surviving spouse — $27,700.

What Is a Car Insurance Deductible? | TIME Stamped

Click. the menu icon. in the top-left corner of your screen. Under Business, select Billing. Select Payment settings in the left-side navigation. Click Business information. Update your business name and address under Business information (Note: Depending on your country, some advertisers will also need to VAT or GST information .) Click Save. Tax Benefit on Home Loan Interest & Principle F.Y. 2023-24

Source Image: blog.saginfotech.com

Download Image

9 insider tips to make filing your taxes easier and cheaper Click. the menu icon. in the top-left corner of your screen. Under Business, select Billing. Select Payment settings in the left-side navigation. Click Business information. Update your business name and address under Business information (Note: Depending on your country, some advertisers will also need to VAT or GST information .) Click Save.

Source Image: nbcnews.com

Download Image

Are Home Improvements Tax-Deductible? | Dumpsters.com Jan 27, 2024The amounts begin to phase out at: $182,100 in 2023 and $191,950 in 2024 for taxpayers not filing a joint return. $364,200 in 2023 and $383,900 in 2024 for married taxpayers filing jointly. Charitable contributions: You can deduct up to $300 in charitable cash contributions on top of your standard deduction for 2020.

Source Image: dumpsters.com

Download Image

Top Tax Breaks for Online Businesses: 4 Expenses to Claim Nov 29, 2023How a car insurance deductible works. If you have a $500 deductible and your repair costs are $2,000, you’d pay the initial $500 and your insurance company would cover the remaining $1,500. Generally, your insurance company subtracts the deductible amount from your claims payout. You’ll be responsible for paying the $500 directly to the

Source Image: memberpress.com

Download Image

Rental property deductions: The do’s and don’ts! You’re responsible for your policy’s stated deductible every time you file a claim. After you pay the car deductible amount, your insurer will cover the remaining cost to repair or replace your vehicle. … Based on paying $420 for collision coverage on a six-month policy, the chart below shows how adjusting a deductible can change the coverage

Source Image: insights.taxinstitute.com.au

Download Image

Tax Tips for Caregivers: 5 Ways to Save When Caring for Elderly Parents | National Church Residences To get started, follow these steps: Visit the Content Claiming Portal. Click Create claims to upload selected reference files and choose your desired enforcement. Once processed, you’ll see a green checkmark under Status. There’s no limit on how much content you can claim in total, but you can upload up to 50 works to the portal at a time.

Source Image: nationalchurchresidences.org

Download Image

Are IRS payments tax deductible? Feb 21, 2024Changes to credits and deductions for tax year 2023. Standard deduction amount increased. For 2023, the standard deduction amount has been increased for all filers. The amounts are: Single or married filing separately — $13,850. Head of household — $20,800. Married filing jointly or qualifying surviving spouse — $27,700.

Source Image: anthemtaxservices.com

Download Image

9 insider tips to make filing your taxes easier and cheaper

Are IRS payments tax deductible? A deductible is the amount you pay out of pocket before your insurance coverage begins, while an out-of-pocket maximum is the total amount you are responsible for paying out of pocket for covered expenses. Once you reach your out-of-pocket maximum, your insurance will cover the remaining costs. 8.

Top Tax Breaks for Online Businesses: 4 Expenses to Claim Tax Tips for Caregivers: 5 Ways to Save When Caring for Elderly Parents | National Church Residences You’re responsible for your policy’s stated deductible every time you file a claim. After you pay the car deductible amount, your insurer will cover the remaining cost to repair or replace your vehicle. … Based on paying $420 for collision coverage on a six-month policy, the chart below shows how adjusting a deductible can change the coverage